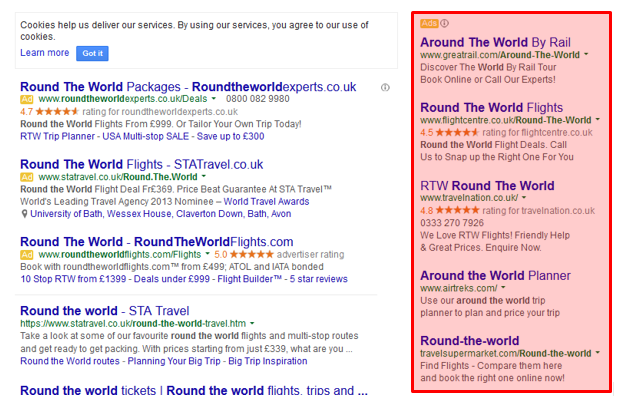

Google have very recently announced (through reliable sources) that they will no longer be serving text ads on the right hand side of Google Search Results i.e. the ads in red below will no longer exist.

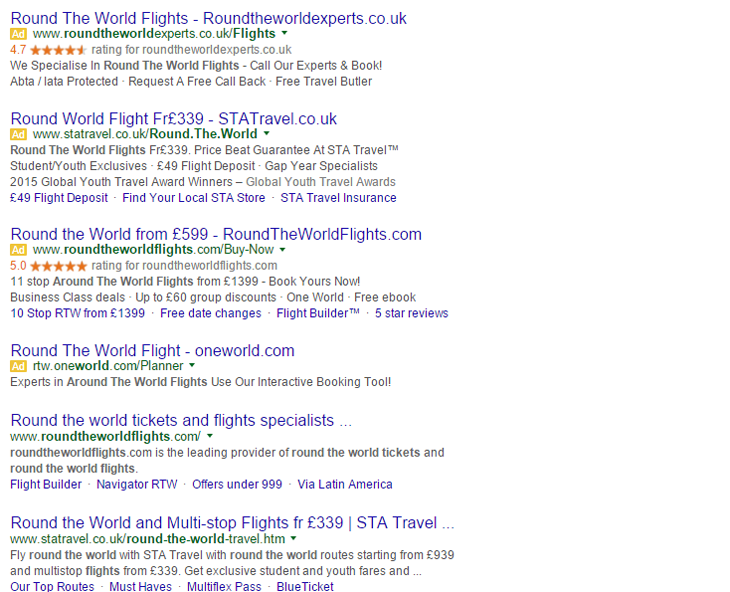

Therefore the search results page will look like this going forward:

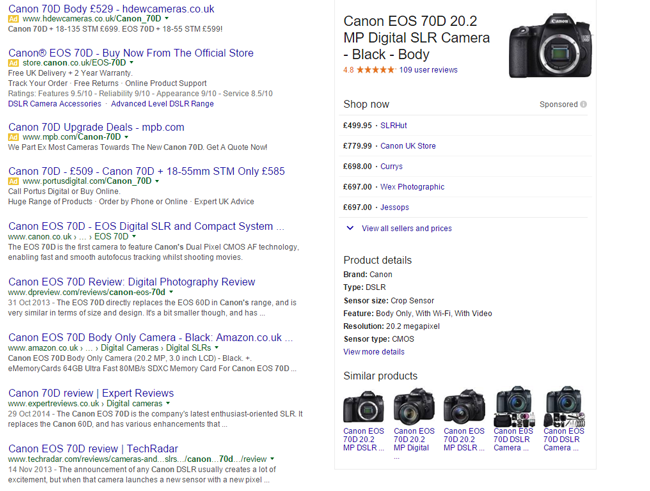

Ads will still appear on the right hand side, however they will only be Google Shopping ads or ads within the Knowledge graph:

From the two screenshots above you will also notice a couple of more significant changes:

- There are 4 text ads above the organic results (rather than a maximum of 3).

- For product specific searches, Google Shopping ads are increasingly being shown within the Google Knowledge Graph rather than the tradition Product Listing Ads (PLA) ad format.

What is the potential impact of these changes?

In my opinion the scale of the impact is largely dependent on the industry reaction to these changes rather than the changes per se…

Click-Through Rate

Google have been running tests on these changes since 2010 and they obviously have the data that these changes will result in more clicks on paid ads (usually the only reason Google makes a change like this) so from a paid search click-through rate (CTR) perspective there shouldn’t really be a negative impact, only a positive.

From the data I see this makes sense as no-one ever really clicked on the right hand side ads anyway (I have never seen the average CTR higher than 0.8% for those ads) and so the extra ad slot above the search results should increase average CTR rates.

Traffic

It’s also worth mentioning that “average position” is not weighted. For example, a keyword with an average position of 4 may show once in positions 1, 2, 3, 4, 5, 6, 7. The clicks will all come from when the ad is in the higher position and so the increased number of ads above the organic results will more than compensate for no right hand side ads and as a result I do not expect traffic to be effected.

Ad Visibility

The most likely metric to be effected is impressions and thus visibility as there used to be 7-8 ads visible above the fold and now there are only 4, however as most search campaigns are judged by traffic, and post click engagement this should (in theory) not be an issue.

For eCommerce companies Google Shopping has been the shining light of non-brand revenue for some time now and this change may result in budget shifts from text ads to Shopping ads on competitive products.

Lead generation is a harder one to gauge (especially on highly competitive terms) as smaller companies with lower budgets will be seen much less often, although if the two metrics above stay the same then this could be overlooked.

Average CPC

If the majority of the industry agree with me on CTR and traffic then cost per click (CPC) should stay the same as no-one will be panicked into ensuring they have a higher ad position, however, it’s possible that due to less impressions/visibility this may happen. As more data becomes available this is something to watch out for, although the data on our clients to date since the switch (and the months of data from when Google has been testing) has yet to indicate an increase in the average CPC will happen.

Summary

- The changes themselves will not result in much CTR, CPC or traffic changes, however, the industry reaction to the change may do and this is a harder thing to predict.

- As an agency that prides itself on integrated SEO and PPC campaigns the biggest potential impact for me is the impact on organic traffic as for many search queries the first organic ranking will now be the 5th on the Search Engine Results Page… so watch this space!

Follow my contributions to the blog to find out more about the latest developments in all things PPC or sign up for the ThoughtShift Guest List email to get all the blogs delivered straight to your inbox.