Americans are on track to spend more than $1 trillion online in 2022, a record amount, according to Adobe’s Digital Economy Index report. For comparison, Americans spent around $812 billion online in 2020, and only $586 billion the year before.

The velocity behind ecommerce won’t be slowing anytime soon. Consumers have adapted to the ease and convenience of online shopping. In fact, they’ve come to expect it. For 76% of shoppers, convenience is a top priority, according to a shopper survey conducted by Linnworks. Another 81% of shoppers say a frictionless ecommerce buying experience is critical.

As a small business owner, you already know that ecommerce is the key to business success. Perhaps you’re one of the many small businesses that fled to the internet when the 2020 pandemic hit. Or maybe you’re an old hand when it comes to selling online. In either case, running a successful ecommerce business requires more than investing in specialist ecommerce web design or building a following on social media. If you’re not tracking these essential ecommerce metrics, you may still be missing the mark.

10 essential ecommerce metrics

Ecommerce metrics have the unique ability to give you even more information about your consumers and their shopping habits than traditional tracking. These data insights will help you make data-backed decisions about your offerings and your ecommerce platform.

But if you’re new to ecommerce, you might find yourself dedicating more time and energy to vanity metrics like page views and social media “likes.” These metrics are good to know, but they don’t tell the whole story. To truly understand how your ecommerce business is performing, you’ll need to dig a little deeper.

Every online business should measure and track the following metrics:

1. Average Order Value (AOV)

Your average order value is the average amount spent each time a customer places an order on your website. Understanding your AOV can help you understand your customers’ purchasing habits. On average, do your customers place small or large orders with your shop?

If your AOV is lower than you’d like, you might look for opportunities to get customers to spend more before checkout. For example, you might offer free shipping when they spend over a certain amount. Or you might try upselling by offering additional products related to the products they’ve added to their cart. Increasing your AOV is a good way to drive revenue and increase profits while avoiding additional transaction fees.

To calculate your AOV for any period of time, divide total revenue by the number of orders.

Revenue / Number of orders = Average order value

AOV can be tracked for any time period but is most often tracked on a monthly basis.

2. Conversion Rate

Your conversion rate is the percentage of visitors that come to your website and “convert” or complete a desired action. For online businesses, that might include placing an order or subscribing to a service.

Conversion rates vary by industry, product, and service. For example, the online shopping conversion rate for food and beverage is around 5%–one of the highest converting categories. The online shopping conversion rate for luxury handbags, however, is less than 1%.

A number of factors impact your ecommerce conversion rate, from website design to brand reputation to the quality of your traffic. To calculate your conversion rate, divide the total number of conversions by the total number of visitors.

Conversions / Visitors = Conversion rate percentage

If you notice any spikes or dips in your conversion rate, you’ll want to dig a little deeper to find out what caused the change.

3. Customer Acquisition Cost (CAC)

Your CAC is the amount of money you spend to acquire a new customer–including marketing and advertising costs, sales personnel costs, and more. Understanding your CAC can help you determine if you’re spending too much or too little to bring new customers in.

As always, there’s no right or wrong answer, but the Small Business Administration recommends allocating around 8% of your revenue for marketing and customer acquisition.

Calculate your CAC by adding up all the costs associated with acquiring new customers. This includes salaries for sales and marketing employees, paid social media campaigns, pay-per-click advertising, and more. Then, divide that amount by the number of customers acquired.

Total acquisition costs / Total customers acquired = Customer acquisition cost

CAC is usually calculated for a specific time range. For example, per month or fiscal quarter.

4. Customer Lifetime Value (CLV or LTV)

Customer lifetime value is the amount your business makes from a typical customer over the lifetime of your relationship. Increasing the value of existing customers is a great way to drive revenue and growth.

CLV goes hand in hand with CAC. For example, if you know it costs $500 to acquire a new customer, and your CLV is less than $500, you’re probably losing money. But if your CLV is closer to $1,000, your customers are contributing to your business.

Calculating CLV can be tricky–there are lots of factors involved including average customer lifespan, customer retention, and more. But the simplest way to calculate your CLV is to multiply the average order total by the average number of purchases in a year. Then, multiply by the average retention time in years.

Average order total X Average number of purchases X Average retention time in years = Customer lifetime value

This total shows how much you can expect a typical customer to spend with your business over their “lifetime.”

5. Customer Retention Rate & Churn Rate

Your customer retention and churn rates are among the most important metrics to track for ecommerce businesses. And they work better together.

Your customer retention rate is the percentage of customers your business retains or keeps over a given period of time. To calculate your customer retention rate, determine how many customers you have at the end of a given period. Subtract the number of new customers you’ve acquired during that period. Then, divide by the number of customers you had at the beginning of the period and multiply by 100. The equation looks like this:

(# of customers at the end of a period – # of new customers acquired in the period) / (# of customers at the beginning of the period) X 100 = Customer retention rate

A high customer retention rate indicates that your customers are loyal to your business–they stick around for the long haul and buy from your company again and again. A low retention rate indicates that your customers churn quickly. That’s where the churn rate comes in.

Your customer churn rate, or rate of attrition, is the rate at which customers stop doing business with your company. To calculate your churn rate, subtract the number of customers you had at the end of a period from the customers you had at the beginning. Then, divide by the number of customers at the beginning of the period. The equation looks like this:

(# of customers at the beginning of the period – # of customers at the end of the period) / #of customers at the beginning of the period = Customer churn rate

A high churn rate indicates that your customers don’t stick around long after making their initial purchase. In most cases, a low retention rate indicates a high churn rate and vice versa. A consistently high churn rate (and low retention rate) indicates a problem with your business. It might be time for a customer satisfaction survey.

6. Onsite Activity Metrics

Don’t confuse onsite activity metrics with vanity metrics. These metrics help you understand what your leads and customers do when they reach your website or online store. Onsite activity metrics measure how long a visitor stays on your site, what pages or products they view, and how they navigate your shop.

When analysing onsite activity metrics, pay close attention to:

Bounce rate

Your bounce rate is the percentage of visitors who navigate away from your site, or “bounce,” after viewing only one page. Bounce rate is calculated by dividing the total number of one-page visits by the total number of entries to your site. Your analytics tool will track your bounce rate automatically. An unusually high bounce rate may indicate a problem with the user experience.

Shopping cart abandonment rate

Your shopping cart abandonment rate tracks the number of visitors who load up their virtual shopping cart only to abandon the cart before finalising the purchase. Shopping cart abandonment rate is calculated by dividing the number of completed checkouts during a given period by the total number of carts loaded during the same period. Then, multiply by 100.

A high cart abandonment rate might indicate a problem with your checkout services. Customers could be thrown off by high shipping fees, limited payment options, or a poor user experience.

8. Email Marketing Metrics

As an ecommerce business, email marketing is an important part of your digital marketing strategy. In lieu of face-to-face interactions, emails are your primary form of contact with your customers. Pay attention to these email marketing metrics to ensure you’re communicating effectively:

Open rate

Your email open rate measures how many people actually open your emails–and how many send them straight to the trash. It’s a good idea to monitor and compare open rates for every email you send. Over time, this data can give you insight about what appeals to your audience.

Click-through rate

Getting customers to open an email is a good start but getting them to actually click your call to action (CTA) is a totally different ball game. Your click-through rate measures the percentage of emails that get at least one click. Comparing your click-through rate across email campaigns can help you pinpoint the types of CTAs that resonate with your audience.

Unsubscribe rate

Finally, your unsubscribe rate measures the number of recipients that choose to unsubscribe from your email communications. If you notice a spike in your unsubscribe rate, it may indicate that you’re sending too many emails or that you’re not reaching your target audience.

Email marketing software like HubSpot, Mailchimp, and Constant Contact track and measure these metrics automatically.

9. Return Rate

In ecommerce, returns happen. In fact, many customers buy online with a plan to return some or all of their items. But ecommerce returns can be a major detriment to online stores. Returned products often can’t be re-sold, and if you offer free returns (a requirement for many online shoppers) you’ll eat the cost of shipping as well.

Understanding your return rate can help you understand how often shoppers return items at your online store. Calculating this rate is simple. Divide the number of units returned by the number of units sold and multiple by 100.

(# of units returned / # of units sold) X 100 = Return rate

A high return rate means a lot of shoppers are returning purchased items. Keep your return rate in check by ensuring product information is accurate, including photos. Pack and ship items safely and securely to avoid shipping damage. And push for store credit refunds over cash.

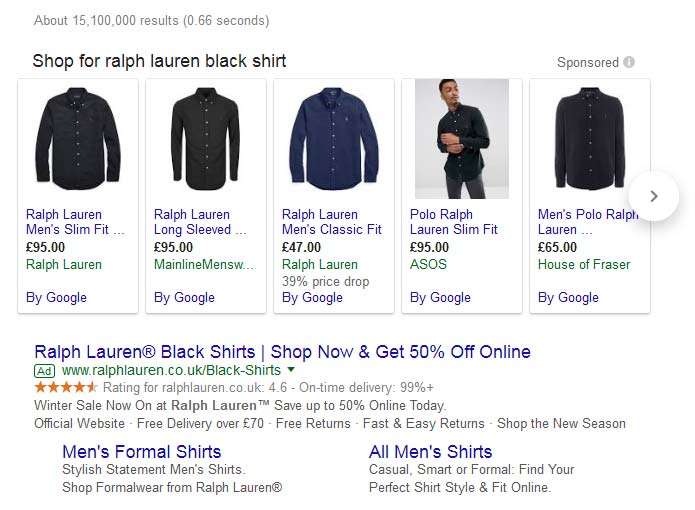

10. Search Traffic

Search metrics allow you to see where your customers are coming from and how they’re finding your shop. Are they searching for specific terms in search engines? Are they looking for a specific product or service? Did they find you through a social media site? Tracking your search metrics helps you answer these questions and react accordingly.

Understanding which products or services leads and customers are searching for allows you to optimise your shop to serve the most people. And knowing where they come from helps you understand the full customer journey. If you notice that most of your leads are finding you on Instagram, you can safely assume Instagram is the social platform you should dedicate the most time and energy to.

Tools like Google Analytics, Adobe Analytics, and SEMrush make it easy to track and understand your website’s online performance.

Online and on track

Businesses that operate online feel more confident about their prospects and future success than those that operate primarily from a brick and mortar location, according to a QuickBooks ecommerce report. By now, it’s easy to understand why. Online businesses bounced back faster when the 2020 pandemic hit–in fact, many ecommerce businesses saw higher-than-expected profits in 2021.

For businesses of all types and sizes, ecommerce is the key to prosperity–both now and in the future. And tracking these essential ecommerce metrics are key to your success.

This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. Additional information and exceptions may apply. Applicable laws may vary by state or locality. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Intuit Inc. does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Readers should verify statements before relying on them.