You want as many new customers as possible, but at what cost? Spend too little and you miss out on sales; spend too much and you’re unprofitable. The math has to work for your marketing to work effectively.

But let’s not pull out the calculus textbooks just yet. There’s a simpler way to pulse check whether your customer acquisition strategy is on track and sustainable—and that’s to look at solid benchmark data.

We surveyed 270 ecommerce business owners* selling finished goods across multiple business verticals to understand the average customer acquisition cost for their brands, along with what marketing channels drove the most customers and sales. The results both confirmed and challenged some of our assumptions.

Left your graphing calculator at home? We’ll also detail how to quickly calculate customer acquisition cost and what to look out for when assessing your business model’s viability. 👀

💰Table of Contents

What is customer acquisition cost?

Customer acquisition cost (CAC) is the cost to your business of acquiring a single customer. That includes product costs, labor costs, marketing costs, and any other costs that contributed to getting your product into a customer’s hands.

It’s important to understand your CAC because it gives you an idea of how much you need to earn from each customer in order to have a profitable business. Put simply, if you’re spending more to acquire customers than customers are spending on your business, your business model is not viable—but more on that later.

How to calculate customer acquisition cost

Most businesses look at their customer acquisition cost to understand how successful their marketing strategies and campaigns are. You might not be a marketer by trade, so understanding how much marketing effort and spend you should allocate to acquire a customer can be quite challenging.

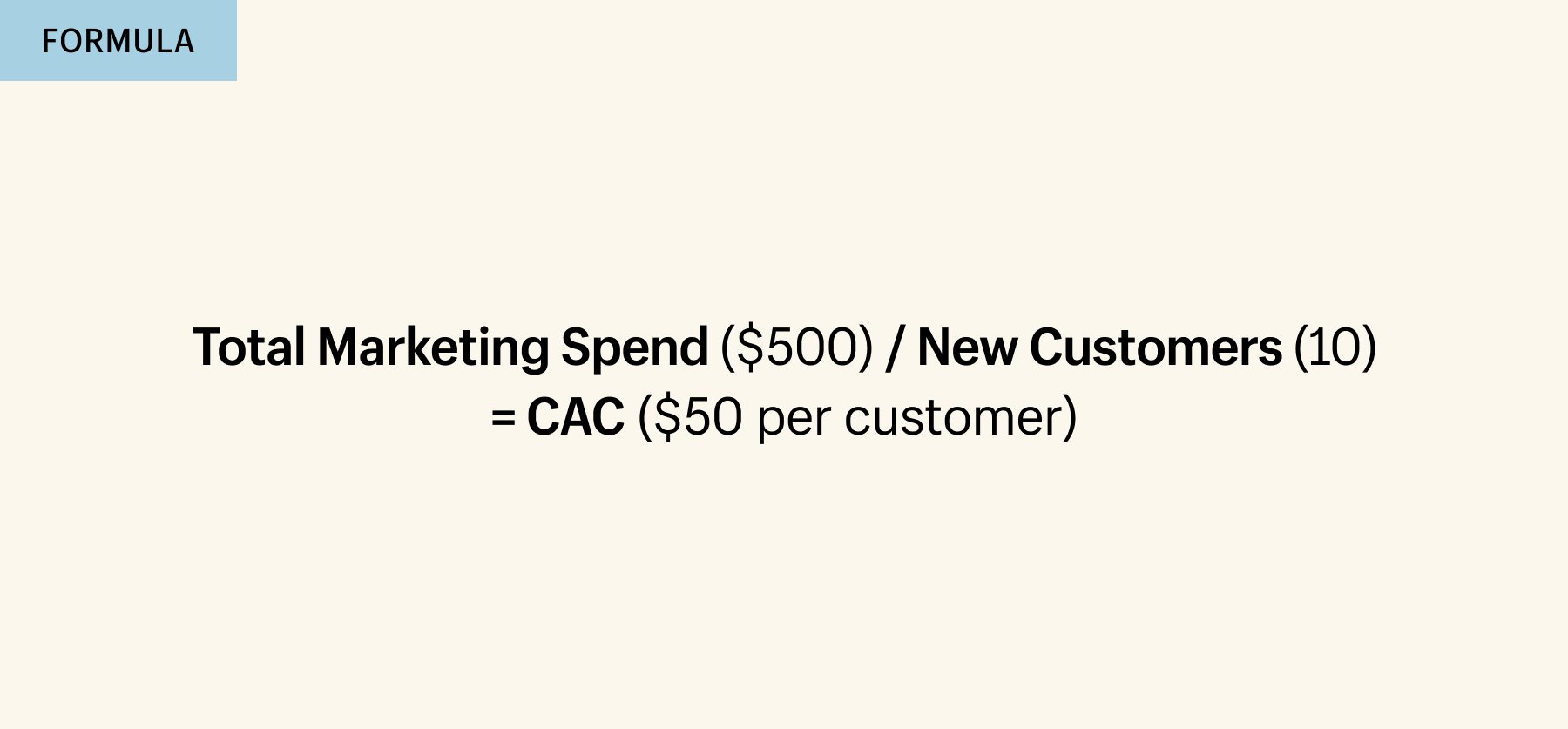

To keep this CAC calculation simple, we’re going to imagine that the only cost going into acquiring a customer is the cost of marketing. Ready?

Let’s say you spent $500 on Google Ads and those ads brought in 10 customers a month. Your customer acquisition cost would be $50:

A more precise way to think about customer acquisition cost

The above calculation is the most basic way to calculate customer acquisition cost, and it’s usually effective enough for businesses that are just starting out. If you’re struggling with marketing in particular, this calculation will give you a good idea if your marketing is on the right track.

But there are other costs that go into your day-to-day operations that influence your true customer acquisition cost and determine your overall profitability.

We’ll keep the accounting jargon to a minimum, but there are three key terms you should understand when you’re calculating your CAC and assessing business profitability:

- Cost of goods sold (COGS). As you create your products, you’re incurring costs. Everything from purchasing raw materials to the labor involved in manufacturing your products is included in your cost of goods sold. In other words, it’s all of the costs and expenses directly related to the production of your goods. It excludes indirect costs, such as marketing and sales. You should tack COGS onto your total marketing spend in order to do an honest accounting of your CAC. A more precise CAC calculation looks like this:

- Average order value (AOV). Average order value tracks the average dollar amount spent each time a customer places an order on your website or in your store. To calculate your company’s average order value, simply divide total revenue by the number of orders.

- Gross profit or margin. The gross margin represents the amount of total sales revenue that your company retains after incurring the direct costs associated with producing your goods. (You want high gross margins, because that means you’re retaining more revenue.) Gross margin may appear as a dollar value or as a percentage.

Why do you need to know all this? Because your customer acquisition cost on its own isn’t enough information. You calculate it in order to understand how profitable your business is. In order to do that, you need to factor in your AOV and gross margin.

📚Resources:

Predicting CAC based on marketing spend

Getting your marketing budget right is half the battle—and the hardest-won battle for early stage founders. Since marketing is often the bulk of the customer acquisition cost and the most flexible cost in your equation, in that you can play with your marketing budget more than you can with say, your raw material costs, it’s a number worth digging into.

As a rule of thumb, you shouldn’t spend more than 5% to 8% of your total budget on marketing.

As a rule of thumb, you shouldn’t spend more than 5% to 8% of your total budget on marketing. But beyond that, our data shows that how much ecommerce brands spend on marketing depends slightly on the industry they’re in.

You can use these industry benchmarks to estimate what your marketing budget should be or to check if your current marketing spend is on track.

📊 What our research shows

On average, ecommerce businesses with less than four employees spend the following on marketing annually:

- Arts and entertainment: $8,185

- Clothing, shoes, and/or accessories: $7,404

- Electronics and/or electronics accessories: $12,156

- Food, beverage, and tobacco: $10,695

- Furniture: $12,980

- Health and beauty: $4,939

- Home and garden: $6,988

Customer acquisition cost by industry

Now that you have a better idea of how much businesses like yours are spending on marketing in order to acquire customers, let’s take a look at the average customer acquisition cost by industry.

📊 What our research shows

For ecommerce brands with less than four employees, the average customer acquisition cost by industry is:

- Arts and entertainment: $21

- Business and industrial: $533

- Clothing, shoes, and/or accessories: $129

- Electronics and/or electronics accessories: $377

- Food, beverages, and tobacco products: $462

- Health and beauty: $127

- Home and garden: $129

Like with all industry benchmarks, please interpret these numbers with caution. The figures above are averages that can vary significantly from brand to brand, depending on several factors, including the target market you’re in, the size of your team, and your average order value.

For example, if you have employees, your CAC will be higher than a business without any employees because salaries are factored into the cost to acquire a customer.

Or if you’re a luxury clothing brand with higher product costs, your CAC will be a lot higher than a print-on-demand t-shirt business—even though you’re technically in the same industry. But your average order value and net revenue will also be a good deal higher, which means you’re still profiting from each customer, despite a higher CAC. Knowing your CAC is helpful, but it’s not the full picture.

Knowing your CAC is helpful, but it’s not the full picture.

How each marketing channel contributes to customer acquisition and sales

Pumping money into marketing campaigns doesn’t necessarily mean you’re going to get a return on your investment. In order to create a more precise marketing strategy and budget, you want to assess your profitability by channel. That means looking at both customers acquired and sales generated.

If you’re just starting out, we dug into the data to see which marketing channels drove the most sales for ecommerce businesses like yours.

📊 What our research shows

Across industries, this is how many customers were acquired by each marketing channel on an annual basis (on average):

- Social media: 1,614

- Outdoor advertising: 1,188

- SEO: 1,025

- Remarketing: 921

- Paid social (Twitter, Instagram, Facebook, TikTok): 776

- Email marketing: 611

- PPC/SEM (Google Ads): 523

- Direct mail: 462

- Traditional advertising: 400

- SMS/text marketing: 365

- Pop-up shops: 279

- Tradeshows and in-person events: 248

- Other: 112

In terms of overall contribution to business revenue (total sales), our research found that there are a few channels every ecommerce brand should be prioritizing from the get-go. Regardless of industry, the data shows that social media, paid social, and email marketing were the top three converting marketing channels.

📊 What our research shows

On average, this is how each marketing channel contributed to overall business revenue:

- Social media: 32.2%

- Paid social: 14.2%

- Email marketing: 12%

- Tradeshows and in-person events: 6.9%

- SEO: 5.3%

- SMS/text marketing: 5.2%

- Traditional advertising: 5%

- Pop-up shops: 4.3%

- Direct mail: 3.7%

- Outdoor advertising: 3.6%

- PPC/SEM: 3%

- Remarketing (targeting abandoned cart shoppers): 3%

- Other: 1.8%

💡TIP: Based on our data, social media and email marketing are two channels to prioritize no matter what your marketing budget is. If you have a bigger budget or if you have a high-revenue business earning $100,000 a year or more, PPC/SEM, remarketing, outdoor advertising, and direct mail might be four channels to consider investing more in.

So, is your business model viable?

By now, you probably have a good idea of what marketing tactics and channels may not be serving you in the long-run, so let’s put your theory to the test. You’ll want to take all of the information we’ve outlined above—your total marketing spend, your total number of customers acquired, and your average order values—to figure out if your business model is viable.

The real challenge of customer acquisition cost is spending the right amount to drive new customers to your product without jeopardizing the lifetime value of and revenue from that customer. Customer lifetime value (LTV) is the predicted amount a customer will spend on your product throughout their entire relationship with your brand.

For example, if your AOV is $100 and, on average, a customer shops with you four times every two years, you would calculate your LTV like this:

Average Order Value ($100) x Number of Transactions (4) x Retention Time Period (2) = Customer Lifetime Value ($800)

To summarize, business model viability will come down to balancing two variables:

- Customer acquisition cost

- The ability to monetize those customers, or their lifetime value

The higher your LTV is relative to your CAC, the faster your business can grow. Generally speaking, a ratio greater than 3:1 is considered “good.”

You would then compare your LTV to your CAC. Your LTV:CAC ratio basically tells you how long it takes to recoup the investment required to earn a customer. The higher your LTV is relative to your CAC, the faster your business can grow. Generally speaking, a ratio greater than 3:1 is considered “good.”

How to lower customer acquisition cost

If your LTV to CAC ratio isn’t 3:1 or higher, it means your business isn’t operating optimally and you’ll eventually run out of money. In this case, I’d urge you to lower your customer acquisition cost. There are a couple of ways to do this for an ecommerce business without drastically impacting your brand. Start with these simple tips:

1. Prioritize organic marketing

The proof is in the data: organic marketing channels like social media, email marketing, SEO, and referral marketing are effective at driving customers to your store without costing you much (aside from your time, of course).

Understanding the ins-and-outs of organic marketing strategies isn’t intuitive to most entrepreneurs, so we pooled some resources to help you get started.

📚Resources:

2. Focus on your AOV

CAC and pricing go hand in hand: without knowing how much it costs to increase your customer base and expand the brand, you can’t know how to price your products. In the case of high CAC, it’s possible you’ve either priced your products too low or you’re spending ineffectively on marketing.

If your marketing budget is less than 8% of your revenue and you’re prioritizing the channels that we’ve outlined above, then take a closer look at your pricing. Increasing it slightly can give you a higher average order value, which means a higher gross margin per order. This way, you can afford a higher customer acquisition cost. You can increase average order value a few ways:

3. Lower your cost of goods sold

If you’re confident that your marketing strategy and pricing strategy are all buttoned up, you might need to cut back on your cost of goods sold. Ask yourself:

- If you’re purchasing raw materials, is your supplier competitive on price? Are there cheaper materials you can substitute that won’t impact your brand?

- Can you lower manufacturing costs?

- Is there any way to streamline the production process and lower labor costs?

- Have you negotiated your shipping costs?

Driving growth—but not at all costs

For early-stage companies, the challenge with assessing if your CAC is sustainable is that you don’t have enough historical data to work with. That’s where the industry benchmarks can help you gauge if you’re on the right track, or point you in the right direction as you start experimenting with marketing campaigns.

If you’re an established business and you’re still lacking quality data, it’s time to start tracking your marketing efforts. For Shopify storeowners, your overview dashboard will provide you with most of the information you need.

Lots of customers coming through can give you the illusion that your business is on the up. But without digging deeper to understand how much it’s actually costing you to acquire customers relative to how much you can monetize those customers, it’s impossible to know if you’re growing your business sustainably.

Remember: growth is important—but not at all costs.

* Data in this article is based on research conducted by Shopify and Angus Reid. Research data was collected via an online survey among US ecommerce business owners with less than 4 employees (n=276) in July 2021. All values are rounded averages. All data is unaudited and subject to adjustment. All financial figures are in USD unless otherwise indicated.