Google sent an email out to advertisers on Tuesday 1st September 2020 informing them that from 1st November 2020 new DST Fees would be added to their PPC media fees invoice or statement. This follows in the stead of Amazon, who raised fees for sellers selling in France last year and on 1st September also raised fees for sellers selling in the UK. On the same day Apple also announced that proceeds of developers would be adjusted in certain countries in light of the DST.

What is DST, or digital service taxes?

DST Fees are the Big Tech companies’ way of passing the digital services taxes onto their customers

The DST in DST Fees stand for “digital service taxes”, and the imposition of DST Fees are a direct response to the imposition of digital service taxes, which are a relatively new phenomenon. Under consideration since 2018 in the EU and much talked, these taxes require tech giants to pay corporation tax where their consumers are, not just where their production is, and are intended to counter the ease at which multinational companies with non-tangible goods can report the majority of their profits in countries where they are required to pay little to no corporation tax, or where, as is the case for Apple in Ireland, they have selective tax benefits. The non-tangible nature of the services of Big Tech companies make it harder to challenge the pricing around them in court, so the surest way for governments to get them to pay tax is to impose a digital service tax.

The decision to impose the taxes is currently being made on a country by country basis, as plans for an EU-wide digital service tax and a global digital service tax have both been unsuccessful so far.

In the UK, digital service taxes were introduced in April this year, and tax businesses that:

- provide a social media platform, search engine or an online marketplace to UK users

- have worldwide revenue over £500m where more than £25m come from UK users

What are DST Fees?

DST Fees are the Big Tech companies’ way of passing the digital services taxes onto their customers. These companies include Google, Amazon, Facebook and Microsoft, and many of them are primarily based in the US. So far only Amazon, Google and Apple have reacted to the taxes by raising the cost of some of their services. Though Facebook has stated “at present, we don’t intend to pass on the costs of the Digital Services Tax incurred by Facebook to our UK customers”, they are expected to be the next to impose DST Fees.

How much are Google’s DST Fees?

Google’s DST Fees are a percentage of the advertiser’s spend on digital ads that are served in the UK, Austria and Turkey. As with Google ad spend, the amount is subject to taxes such as VAT.

- 2% UK DST Fee – ads served in the UK will be charged a fee that’s 2% of the ad spend.

- 5% Austria DST Fee – ads served in Austria will be charged a fee that’s 5% of the ad spend.

- 5% Regulatory Operating Cost – ads served in Turkey will be charged a fee that’s 5% of the ad spend.

US President Donald Trump’s threat to impose more trade tariffs on countries that impose the DST has been a big factor in the failure of a multinational adoption of the DST, but there are countries other than the UK, Austria and Turkey that have imposed taxes on digital services independently, so expect the list of countries to grow.

Who will Google’s DST Fees affect?

Google’s DST Fees will affect those who advertise on the so far free-to-use Google Ads platform, which consist mainly of small and medium sized businesses, who already pay money to Google in order to show ads on Google (including Google Shopping, YouTube, Google Maps, and the Google app) and their network of partner websites and apps such as Amazon.com and sites like The Guardian that use the Google Custom Search Engine to power their onsite searches. This is the currently known situation, as Google has not added the fees to other products such as the 360 suite which larger enterprises use, though it is also expected that they will do so in future. It is unfortunate for SMBs that the fees, which were to be expected but could have been postponed, are being imposed while they are still struggling to get through the COVID-19 pandemic. The Google Ad Credits that SMBs received earlier on this year may have led them to believe that they would be given financial help from Google, when in fact the impact of the fees may end up cancelling out or impeding their recovery.

Google’s DST Fees will affect advertisers globally, as long as they are advertising to people in a country where the DST Fees have been imposed. For example, if you are based in the US but advertising in the UK, Austria or Turkey, you will be paying the DST fee.

How can I calculate what the DST fee will cost me?

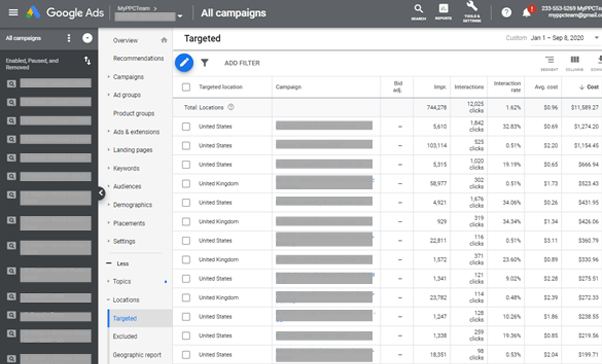

If you only target a single country among those in Google’s new fee list (the UK, Austria or Turkey) then it’s simple, just calculate the relevant percentage of your account’s ad spend.

If you target multiple locations, go to the location report (in the left-hand navigation) and filter by location before calculating the 2% or 5% percent sum.

Bear in mind that the campaigns currently enabled may not be the same campaigns enabled come November, and that spend levels may be different, especially if you are an ecommerce business that run sales over Black Friday and Cyber Monday.

How should I prepare for November, when DST Fees come into effect?

If you do not want to serve ads to people who search from the UK, Austria or Turkey, then make sure you exclude these locations. This is because the 3 location targeting options,

- target “people in, or who show interest in, your targeted locations”

- target “people in or regularly in your targeted locations”

- target “people searching for your targeted locations”

may contain people who search for your non DST-affected location while in the UK, Austria or Turkey, or contain people who are regularly in your non DST-affected location but at the time of searching are in the UK, Austria or Turkey.

The DST Fee won’t be factored into automated bid strategies for campaigns with CPA (cost-per-acquisition) bidding, so recalculate your target CPA.

Also review your budget as from November onwards an original monthly budget of £10,000 will end up costing £10,200 pre-tax, a budget of £50,000 will end up costing £51,000, a budget of £100,000 will end up costing £102,000 and so forth. Ecommerce companies reserving a large proportion of the annual budget for Black Friday and Cyber Monday may wish to reserve even more.

Read our tips on how to easily increase your Google Ads ROI and use them to manage your account.

Sign up to a free digital strategy consultation with ThoughtShift. We specialise in PPC advertising and social media advertising for ecommerce websites and would be happy to help.

Follow my contributions to the blog for more digital marketing news updates, or sign up to the ThoughtShift Guest List, our monthly email, to keep up-to-date on all our new blog posts.