Recent research has shown that an improving housing market and a more design orientated customer has driven growth in the furniture industry. The Office of National Statistics recorded that stores specialising in furniture and lighting saw a 23.4% increase in the volume of products sold year on year and a 22.4% increase in spending year on year in 2014. According to the ONS this was the largest increase in both measures since records of this type began in 1988 (1). This changing landscape of the housing market combined with the evolution of customer purchasing behaviour is providing opportunities for the furniture industry as well as challenges. Here we look at some key benchmarks in the furniture industry and the key factors driving change.

How does the furniture industry compare to other areas of retail?

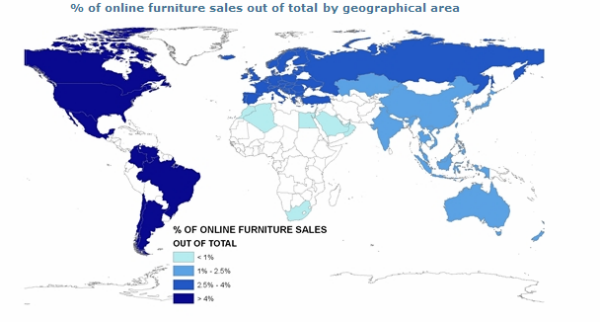

Some of the latest data available for the UK shows that online sales accounted for 11.7% of all retail sales in Dec 2013 (2) whereas the furniture sector only attributed 2.6% of total sales to online, globally in 2013 (3). Furniture is not an industry which has experienced the fastest eCommerce penetration but it continues to grow. The below map is taken from 2013 and reflects global online furniture sales for this period.

Two Thirds of In-Store Furniture Purchases Influenced By Online

Research from Google US in 2012 (4) shows some interesting online trends proving the importance of online in driving furniture sales both online and in-store including:

- 66% of in-store purchasers accessed the internet while looking for information on furniture. Demonstrating the value of online when influencing offline sales

- On average, online furniture purchases were searched 14.2 times

- Online purchasers research often but are quick to decide: 63% of purchasers visited multiple brand sites and over half purchased within one week of researching

- 49% of online furniture purchases followed a non-branded query

Online retail sales set to grow 40% by 2016

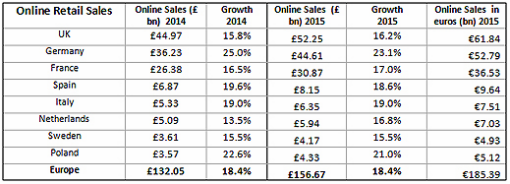

eCommerce is undeniably expanding and is reported as the fastest growing retail market in Europe. Sales in the UK, Germany, France, Sweden, The Netherlands, Italy, Poland and Spain are expected to grow from £132.05 bn [€156.28 bn] in 2014, to £156.67 bn [(€185.39 bn] in 2015 (+18.4%), reaching £185.44 bn (€219.44 bn) in 2016 (+18.4%). From 2014 to 2016 this is a projected growth of 40.43%. (5)

This data estimates £44.51 billion of online sales in the UK in 2015 (5). With the furniture industry lagging behind in eCommerce sales, what barriers are inhibiting customers from purchasing online and how can the industry grow in order to take advantage of the huge eCommerce opportunities.

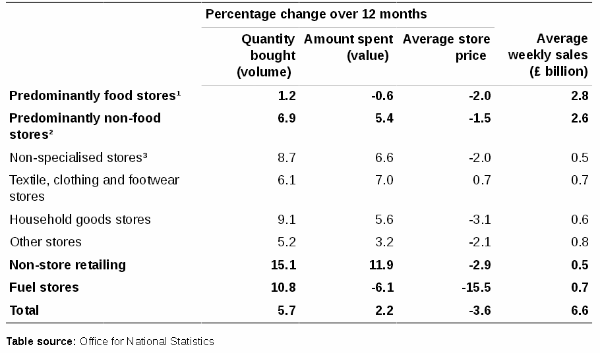

Household goods purchase volume increasing whilst purchase order value is decreasing in the world of retail

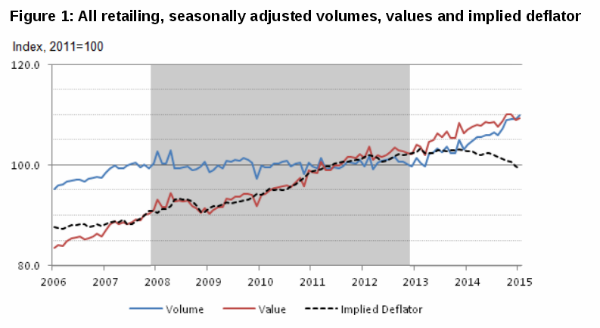

Statistics from the Office for National Statistics reported in February 2015 average store prices fell for the eight consecutive month, falling by 3.6% year on year in February 2014. This is reportedly the largest year on year fall since consistent records began in 1997. (6) The below table is taken from the report analysing the last 12 months. Included in the household goods stores data is the furniture industry. Although this is obviously not a 100% accurate portrayal of furniture industry data, it does give some indication of the market growth in this area.

£0.6 billion weekly household goods sales, £0.5 billion non-store sales (including online)

The household goods sector is vast containing everything from baby items and plates to refrigerators and vacuum cleaners. These items greatly vary in price, but no more so than the clothing and footwear industry which has accessory items for a couple of pounds up to designer items worth thousands. If we compare the two industries it is evident that the clothing industry has a much better ratio of quantity bought in relation to amount spent and average store price. What we can take from this is a broad sense that the average value of furniture purchases is not growing at the same rate as the volume of purchases.

Across all categories the main trend appears to be the increased volume of purchases with the overall order value for these purchases decreasing. This does indicate a change in user behaviour to being more price focused.

Does this mean that the customer is all about waiting for the sale?

Big sales promotions are nothing new in the furniture industry, particularly in areas such as sofas where it seems there is a constant rotation of different sale offers. Promotional events relatively new to the UK retail calendar like Black Friday are indicative of the current retail trend of sacrificing the value of sales in order to increase the volume. Although it appears on the surface that Black Friday and Cyber Monday drove some impressive figures, with UK shoppers spending £810m on Black Friday and £720m on Cyber Monday (7), many in the retail industry were not happy with the outcome. A comparison of the Black Friday and Cyber Monday periods from 2013 to 2014 show that whilst conversion rates increased by 5.3% year on year and average revenue per session rose 7% year on year, average order value per transaction was down by 1.9%. (7) David McCorquodale, head of retail, KPMG, comments: “Extensive discounting disrupted the timing and rhythm of Christmas spending. Between Black Friday and Boxing Day retailers and consumers engaged in a three-week dance, each waiting for the other to take the lead, and as a result sales suffered.“ (8) Whilst there is no industry specific data available for 2014, in 2013 David McCorquodale’s words rang true for the furniture industry and furniture and flooring was the only category to record lower online growth in November than October. The penetration rate was almost unchanged from 31.9% in 2012 to 32.1% in 2013 (9). As this retail period is more commonly associated with gifting than purchasing home furnishings, this data is not surprising.

What is important to the customer looking to purchase furniture?

The economic climate since the recession in particular has led to a price focused and promotional led marketing strategy for big-ticket items such as furniture. This has been intensified by the growth of eCommerce and the nature of online research and product comparison. Although the consumer has become a little jaded and fatigued by all of these sales, pricing policy is still an integral part of furniture marketing. Research conducted by CSIL suggests (3) that as well as pricing policy the following factors are key elements to online success in the furniture industry:

- Logistics and delivery

- Integration of online and offline data and strategy

It seems customers are becoming increasingly driven to only spend at times when there is a sale and are they less willing to purchase items at full price. So to continue to increase new furniture customer acquisition at similar rates to those previously enjoyed, brand differentiation in logistics and data such as with same day delivery or a single customer view loyalty scheme, rather than competing on price is going to be the key factor in continuing to drive up eCommerce furniture sales.

Thanks for reading

Thanks for reading, if you’re interested in industry developments for online and digital marketing trends, follow my contributions to the blog. Or get the best digital marketing blogs delivered directly to your inbox and get our guest list email.

Sources:

- http://www.ons.gov.uk/ons/dcp171778_377638.pdf

- http://www.furniturenews.net/resources/articles/2015/01/1367511521-statistical-analysis-uk-furniture-industry

- http://www.worldfurnitureonline.com/research-market/e-commerce-furniture-industry-0058529.html

- https://www.thinkwithgoogle.com/research-studies/role-of-digital-in-furniture-path-to-purchase.html

- http://www.retailresearch.org/onlineretailing.php

- http://www.ons.gov.uk/ons/dcp171778_399119.pdf

- https://econsultancy.com/blog/65847-all-the-stats-you-need-from-black-friday-cyber-monday-2014/

- http://www.furniturenews.net/news/articles/2015/01/744354178-furniture-growth-strong-through-december-sales

- http://www.furniturenews.net/news/articles/2013/12/2025273213-online-drives-over-half-non-food-sales-growth