Retail and eCommerce as we know it is ever changing, it’s probably why we like it so much because nothing is ever the same. The market place changes because user behaviour changes as a result of competition or trends. Nothing stands still and there is always something to analyse.

Although Black Friday has been around for some time; for the UK, 2014 was definitely the year I would say it had ‘arrived’. Whilst many eCommerce Managers and Marketers were gleaming over their Nov sales performance following the mayhem that was Black Friday (28th Nov 2014), many still seemed to be stunned when their Dec sales growth didn’t appear as promising as the year before, racking their brains as to why…hmmmmm let me think?

What Goes Up Must Come Down?

Thanks to the wonderful theory of gravity (thank you Isaac Newton) many people will be familiar with the phrase ‘What goes up, must come down…’ (don’t you all be throwing apples in the air now). Whilst eCommerce sales do not depend on gravity, they are similar in the fact that nothing can stay ‘up’ forever. This doesn’t mean your sales performance won’t continue to grow year on year, but let’s think logically about the peaks and troughs we usually expect due to seasonality such as Christmas. Most e-tailers and B2C businesses will thrive on the massive spike in sales they expect to see from the end of November, or more historically, the week or two leading up to Christmas. But with sale periods starting earlier and earlier, discounting further and further and to top it off, a massively hyped up cyber weekend to contend with; can e-tailers really expect the same festive spike year on year?

Is Black Friday the Black Widow of eCommerce?

Consumer’s pay packs will only last so long, especially when they have Christmas gifts to purchase and parties to go to. So what sounds more appealing to the Christmas consumer… buy early and save more from a massive promotional sale, with heavy discounts and potentially further savings on the horizon with stock clearance sales; or shop lastminute.com and potentially risk spending more on late deliveries? It’s no surprise really that it seems the UK Christmas consumer opted for the sale as the British Retail Consortium (BRC) reported that non-food sales online only grew by 7% in December 2014 as opposed to 17% in December 2013, the slowest December growth seen since December 2009. With eCommerce sales in November 2014 claiming 21% of the retail market, the largest market share recorded to date for internet retailing, this indicates that many consumers spent the majority of their Christmas budgets earlier in the year.

I decided to investigate further…

eCommerce Sales YoY % Growth: Nov vs Dec

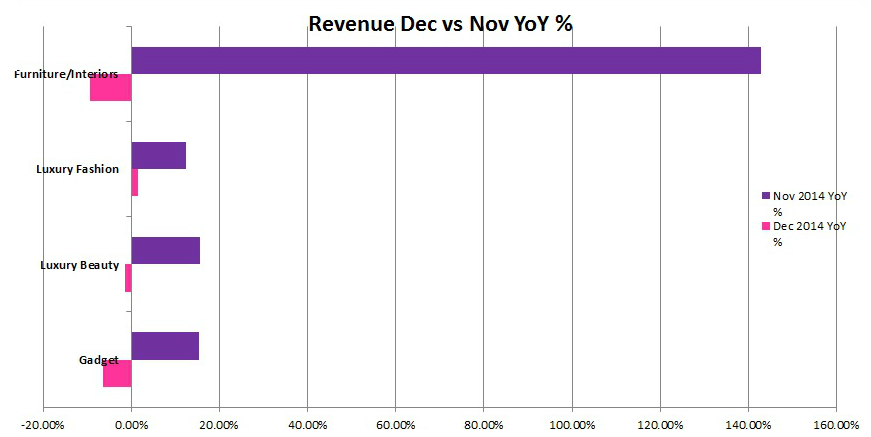

I decided to review three different eCommerce sites from three different sectors to see how the November 2014 Cyber Weekend and early December 2014 sale periods affected their year on year (YoY) growth.

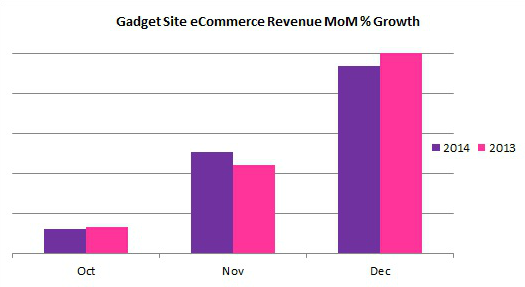

For all three eCommerce sites, I noticed that their month on month (MoM) percentage growth between November and December was lower year on year (YoY) for revenue, number of transactions and for two out of three, average order value. For now, let’s just focus on revenue…

Gadget eCommerce Site

- eCommerce revenue in Dec 2013 had a percentage growth of 127% vs 84% in Dec 2014 (in comparison to November that year), a negative difference of almost 34%

- Meanwhile, eCommerce revenue in Nov 2014 saw a percentage growth of 310% vs 234% in Nov 2013 (in comparison to October that year)

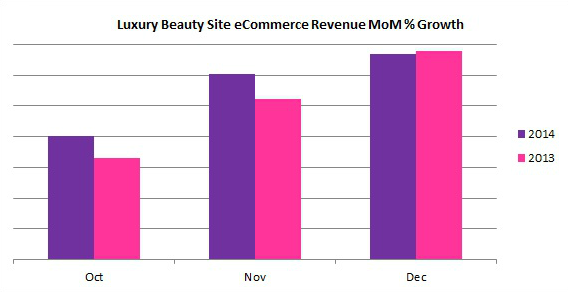

Luxury Beauty eCommerce Site

- eCommerce revenue in Dec 2013 had a percentage growth of 30% vs 10% in Dec 2014 (in comparison to November that year), a negative difference of almost 65%

- Whilst this particular site didn’t invest any marketing efforts in offers surrounding Black Friday, eCommerce revenue in Nov 2014 still saw a percentage growth of 5% (in comparison to October that year). YoY this isn’t as much but it significantly higher than the 10% growth Dec had YoY

Luxury Fashion eCommerce Site

- eCommerce revenue in Dec 2013 had a percentage growth of 56% vs 41% in Dec 2014 (in comparison to November that year), a negative difference of almost 27%, the smallest revenue difference of the three sites

- Meanwhile, eCommerce revenue in Nov 2014 saw a percentage growth MoM of 26% vs -12% in Nov 2013 , so actually saw revenue growth as opposed to the decline seen from October to November in 2013

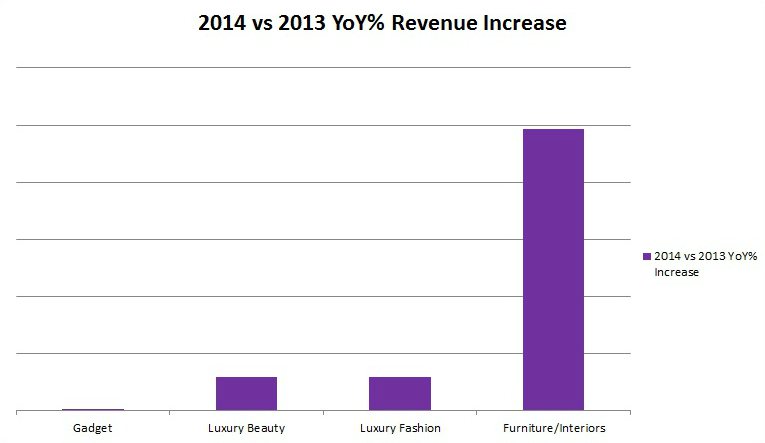

As you can see from the data displayed in these graphs, regardless of industry type within the eCommerce sector, all sites saw a lower percentage increase in revenue growth from November to December 2014. This indicates that December or certainly late December, is no longer the Christmas eCommerce peak, if these lovely Cyber Weekends and sales are anything to go by. When comparing November 2014 vs 2013 and December 2014 vs 2013, the story appears to be very much the same. However, as I have said before, this certainly doesn’t mean that YoY growth for December won’t continue in comparison to its performance the previous year, but it does mean that we need to rethink the eCommerce expectations we have for seasonal periods now that retail, both online and offline is changing. It’s very likely that some consumers still held back some of their Christmas budget until a little later in December following the promise from many retailers of further reductions. Drapers reported that IMRG stated ‘…UK shoppers spent £21.6bn online for the 8 weeks between November 2 and December 27, which was an increase of 13% on 2013….’.

So Is It All About November & December Working Together?

If we are to consider that the buying cycle for Christmas may now be much longer, we should forget about November and December competing against one another and continuing historical trends which now appear to be outdated. We need to look at them as a single buying period and most of you will have probably noticed that collaboratively you’ve still seen a revenue increase 2014 vs. 2013.

Let’s not forget that if you are participating in heavy discount promotions, this is going to affect your revenue growth year on year. Whilst the motto for some of ‘charge less and sell more’, may be true; if your prices are slashed or discounted for what we’d consider to be a lengthy period of time in retail/eCommerce, then the size of the total revenue figure is going to be impacted as such, even if your transactions are up due to your average order value.

From a digital marketing perspective, I would definitely take some learnings from the recent holiday sale periods and note that new trends end up becoming ‘the norm’, so it’s best to start planning your strategy even earlier and implementing it earlier than the ‘previous norm’. More to follow on this in my next blog post but to give some examples as to why I am recommending this:

- Boxing Day became the big post-Christmas sale day once stores starting opening to all vs the previously famous ‘January Sales’

- Now sale periods start way before Christmas, Valentine’s, Easter etc…and for the fashion industry, even before the ‘mid-season’ sales

So how long will it be do you think until ‘Black Fridays’ and ‘Cyber Mondays’ become obsolete and just a part of the norm?

Follow my contributions to the blog to find out more about fashion eCommerce SEO and trends, or sign up to our monthly newsletter, to keep up-to-date on all our blogposts, guides and events.