Pricing your products is one of the cornerstone decisions you’ll make as a business owner. It impacts almost every aspect of your business. Your pricing is a deciding factor in everything from your cash flow to your profit margins to which expenses you can afford to cover.

It also affects your customers. Price sensitivity is one of the key factors to companies’ pricing choices. Customers are well informed about their purchases now, and they are sensitive to price because they want the maximum benefits for their money and time.

Studies have also shown that small variations in price can raise or lower profitability by as much as 20% or 50%.

That’s why it’s all too easy to get stuck on your pricing strategy when you’re launching a new business or product, but it’s important not to let the decision stop you from launching. The best pricing data entrepreneurs can get is from launching and testing with real customers—but you still need to start somewhere, with a price that works.

That’s what we’re tackling in this guide.

Shortcuts ✂️

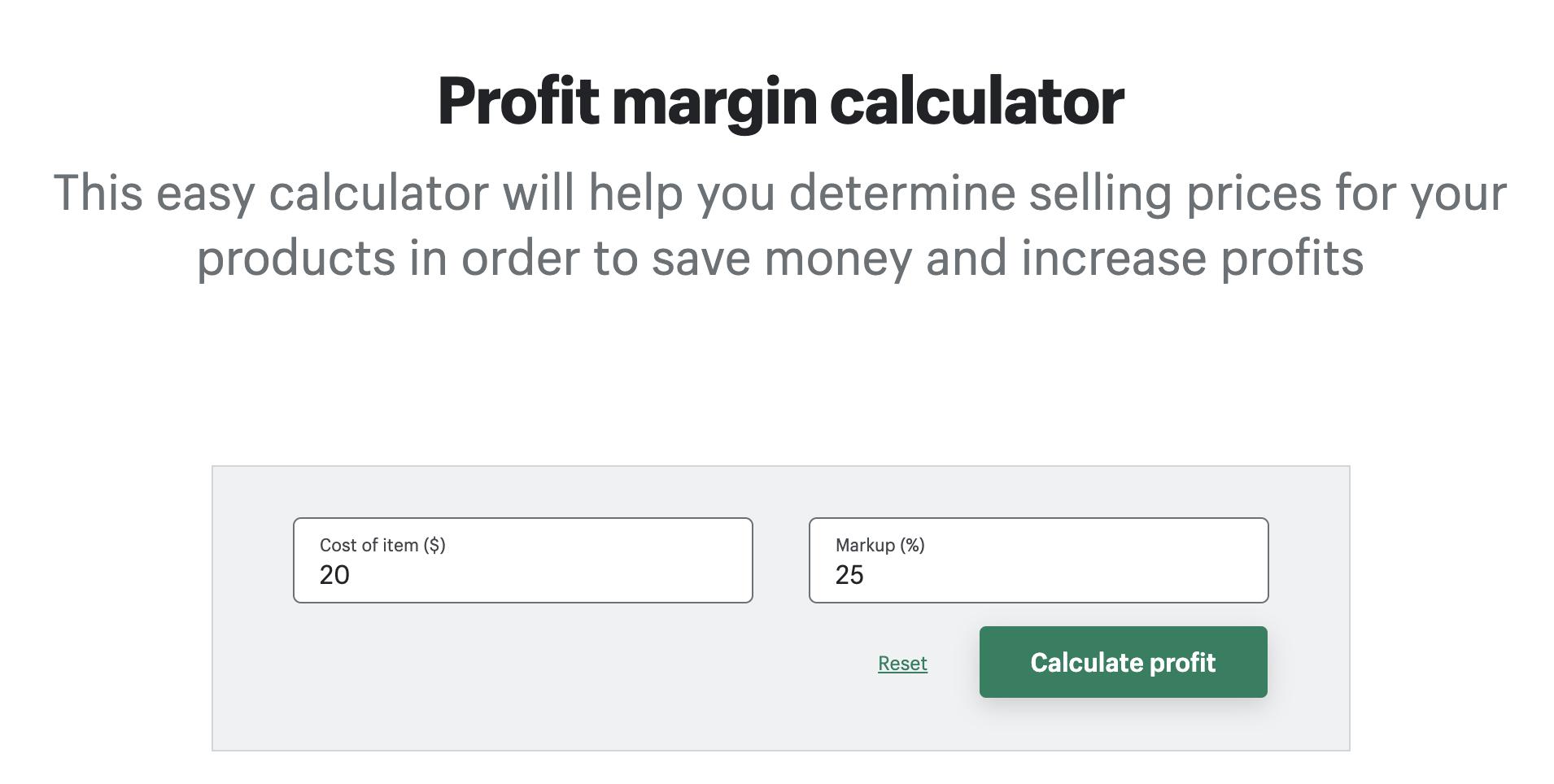

Need an effective pricing strategy for your business? First, you’ll need to figure out your markups and profit margins. Use Shopify’s profit margin calculator to find a profitable selling price for your product.

Use the calculator

How should I price my products?

There are a lot of articles and advice about product pricing. It’s easy to fall into a black hole if it’s your first time pricing a product. Fortunately, there is a simple way to price products so that you sell profitably.

Pricing touches everything from your business finances to your product’s positioning in the market with considerations like whether it’s timeless, bespoke, or a short-lived trending product. It also factors into how you make a profit selling on online selling sites. It’s a key strategic decision you need to make for your business, and it can be just as much an art as it is a science.

But it’s not a decision you only get to make once.

If you’re trying to find the retail price of your product, there is a relatively quick and straightforward way to set a starting price. Remember, just because it’s the price you use to launch doesn’t mean it’s the price you’ll use forever.

To set your first price, add up all of the costs involved in bringing your product to market, set your profit margin on top of those expenses, and there you have it. This strategy is called cost-plus pricing, and it’s one of the simplest ways to price your product.

If it seems too simple to be effective, you’re half right—but here’s how it works.

Pricing isn’t a decision you only get to make once.

Why this pricing model works

The most important element of your price is that it needs to sustain your business. If products are set at a high price and potential customers don’t buy, you’ll lose market share. If you set a low price, you’ll be selling at a loss, or at an unsustainable profit margin. This will make it challenging to grow and scale.

There are other important factors that your pricing needs to account for, like how you’re priced in relation to your competitors, consumer trends, and what different pricing strategies mean for your business and your customers’ expectations.

But before you can worry about anything like that, you need to make sure you’ve found a sustainable base price.

How to price your product

There are three straightforward steps to calculating a sustainable price for your product.

- Add up your variable costs (per product)

- Add a profit margin

- Don’t forget about fixed costs

1. Add up your variable costs (per product)

First and foremost, you need to understand all of the costs involved in getting each product out the door. If you order products, you’ll have a straightforward answer as to how much each unit costs you, which is your cost of goods sold.

If you make your products, you’ll need to dig a bit deeper and look at a bundle of your raw materials, labor costs, and overhead costs. How much does that bundle cost, and how many products can you create from it? That will give you a rough estimate of your cost of goods sold per item.

However, you shouldn’t forget the time you spend on your business is valuable, too. To price your time, set an hourly rate you want to earn from your business, and then divide that by how many products you can make in that time. To set a sustainable price, make sure to incorporate the cost of your time as a variable product cost.

Here’s a sample list of costs you might incur on each product.

| Cost of goods sold | $3.25 |

| Production time | $2.00 |

| Packaging | $1.78 |

| Promotional materials | $0.75 |

| Shipping | $4.50 |

| Affiliate commissions | $2.00 |

| Total per-product cost | $14.28 |

In this example, your total per-product cost is $14.28.

Wondering what kind of promotional materials you might need for your products? One of the most common ones in an ecommerce context is marketing materials or additional gifts to level up your ecommerce packaging and unboxing experience.

2. Add a profit margin

Once you’ve got a total number for your variable costs per product sold, it’s time to build profit into your price.

Let’s say you want to earn a 20% profit margin on your products on top of your variable costs. When you’re choosing this percentage, it’s important to remember two things:

- You haven’t included your fixed costs yet, so you will have costs to cover beyond just your variable costs.

- You need to consider the overall market and make sure that your price range still falls within the overall “acceptable” price for your market. If you’re two times the price of all of your competitors, you might find sales become challenging depending on your product category.

Once you’re ready to calculate a price, take your total variable costs and divide them by 1 minus your desired profit margin, expressed as a decimal. For a 20% profit margin, that’s 0.2, so you’d divide your variable costs by 0.8.

In this case, that gives you a base price of $17.85 for your product, which you can round up to $18.

Target price = (Variable cost per product) / (1 – your desired profit margin as a decimal)

3. Don’t forget about fixed costs

Variable costs aren’t your only costs.

Fixed costs are the expenses that you’d pay no matter what, and that stays the same whether you sell 10 products or 1,000 products. They’re an important part of running your business, and the goal is that they’re covered by your product sales as well.

When you’re picking a per-unit price, it can be tricky to figure out how your fixed costs fit in. A simple way to approach this is to take the information about variable costs you’ve already gathered and set them up in this break-even calculator spreadsheet. To edit the spreadsheet, go to File > Make a copy to save a duplicate that’s only accessible by you.

It’s built to look at your fixed costs and your variable costs in one place, and to see how many units you’d need to sell of a single product to break even at your chosen price. These calculations can help you make an informed decision about the balance between covering your fixed costs and setting a manageable and competitive price.

Find out everything you need to know about performing a break-even analysis, including what to watch out for and how to interpret and adjust based on your numbers.

Using a product pricing calculator

To make life easier, use a product pricing calculator to find a profitable selling price for your products. Shopify’s profit margin calculator is a great way to figure this out. It uses a cost-plus pricing strategy that takes the total costs to make your product, then adds a percentage markup to determine the final selling price.

To start, simply enter your gross cost for each item and what percentage in profit you’d like to make on each sale. Let’s say it costs $20 to get your item on the shelf and you want to mark up the price by 25%.

After inputting your numbers, click “Calculate profit.” The tool will run those numbers through its profit margin formula to find the final price you should charge your customers. You’ll see in the example below that the sale price is $25, your profit is $5, and gross margin is 20%.

Play around with the numbers to find the perfect price point for your customer base and bottom line. If you can charge a higher price, increase your markup. From there, you can effectively set prices and start profiting off each sale.

Test and iterate once you’re live

Don’t let fear of choosing the “wrong” price hold you back from launching your store. Pricing decisions will always evolve with your business, and as long as your price covers your expenses and provides some profit, you can test and adjust as you go. Run a price comparison to see how your strategies stack up against similar products.

Taking this approach will give you a price you can feel confident about, because the most important thing when it comes to pricing is that your pricing helps you build a sustainable business. Once you have that, you can launch your store or your new product, offer lower prices on discounts, and use the feedback and data you get from customers to adjust your pricing structure in the future.

Ready to create your business? Start your free 14-day trial of Shopify—no credit card required.

Product pricing FAQ

How much profit should I make on a product?

What is a good price for a product that costs $10 to produce?

How can I find out how to price a product?

What factors should be considered when pricing a product?

- The total costs of running your business including fixed and variable costs

- Competitors’ pricing

- Market demand

- Target customers spending power

- The value of your product